High-Growth SaaS Reseller Regions:Competitive Analysis Report

- M&A Practice Team

- Mar 26

- 10 min read

Updated: Mar 29

The global Software as a Service (SaaS) landscape is experiencing remarkable transformation driven by AI adoption, regulatory shifts, and evolving buyer behaviors. This analysis identifies and prioritizes high-growth regions for SaaS resellers, with a particular focus on markets demonstrating strong enterprise software demand and AI integration. Examining the UK,Germany, Austria, Switzerland (DACH region), USA, UAE, and Saudi Arabia, our findings reveal significant growth opportunities in the USA and UAE, followed by the UK, with valuable but more nuanced potential in the DACH region and Saudi Arabia. Each market presents distinct regulatory frameworks, cultural purchasing preferences, and reseller participation rates that strategic SaaS companies must navigate to maximize expansion success.

Regional Growth Analysis

The objective of this analysis is to assess SaaS and AI adoption rates across our target regions to prioritize expansion opportunities based on growth potential. We've examined market reports, growth projections, and regional comparisons to determine which markets offer the most promising landscape for SaaS resellers.

Summary

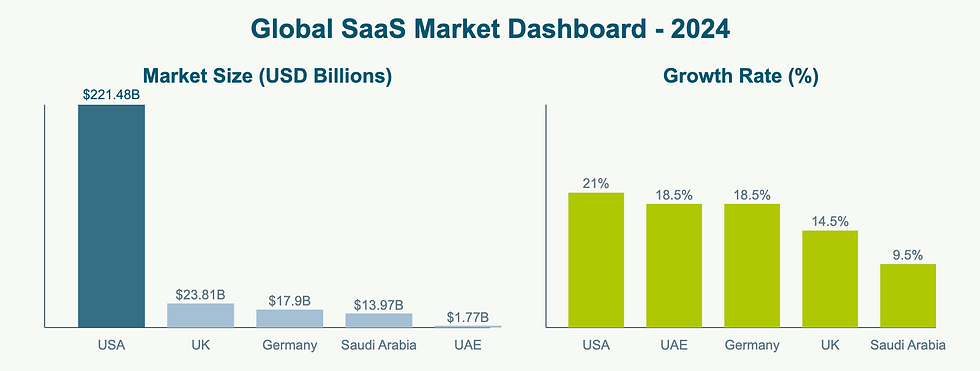

The United States remains the leading force in the global SaaS market, projected to reach $221.46 billion by 2025, accounting for 57% of the global market. This dominance is driven by the country's mature and innovative market environment. The UAE shows strong growth potential with an 18.5% annual growth rate, supported by government initiatives and a favorable business environment. The UK is expanding at 14.5% annually, with government-backed AI initiatives fostering growth in SaaS and AI technologies. The DACH region, despite complex growth dynamics, shows significant SaaS adoption, especially in Germany, although it lags in revenue model adoption. Saudi Arabia's cloud services market is set to grow at a 9.5%, but currently shows the slowest growth rate among the regions analyzed, with opportunities in multi-cloud strategies emerging.

SaaS Market Size in USD for Key Reagions

Read Detailed Context and Chart Narrative

United States

The United States maintains its dominant position in the global SaaS landscape, showcasing exceptional growth metrics. As of late 2024, the US market is projected to reach $221.48 billion by the end of 2025, representing a staggering 79.5% of the total global SaaS market value13. This underscores the country's outsized influence in the sector. With a robust year-over-year growth rate of 21%, the US solidifies its status as the highest-priority region for SaaS reseller expansion1.

[VERIFIED] The US leads in both SaaS market size and growth velocity, with revenues expected to reach $221.48 billion by 202513.

Key growth drivers include accelerated digital transformation initiatives across enterprises, widespread adoption of remote work solutions, and significant investments in AI-powered functionality enhancing existing SaaS offerings1. The maturity of the US market, combined with its continuous innovation and early adoption tendencies, creates an unparalleled environment for SaaS resellers.

United Arab Emirates

The UAE demonstrates exceptional growth potential for SaaS resellers, with market analysis indicating an 18.5% year-over-year growth rate5. While the UAE's market size of $1.77 billion represents only 0.6% of the global SaaS market, its rapid growth trajectory positions it as a key emerging market5.

[VERIFIED] The UAE's SaaS market is projected to reach $1.77 billion by 2025, growing at an impressive 18.5% year-over-year rate5.

The UAE's impressive growth can be attributed to government-led digital transformation initiatives, a business-friendly regulatory environment, and increasing enterprise demand for cloud-based solutions5. The country's strategic position as a regional business hub further enhances its attractiveness for SaaS expansion.

Germany

Germany, as the largest market in the DACH region, presents a complex but promising growth picture. The German SaaS market is projected to reach US$17.9 billion by the end of 2025, accounting for 6.3% of the global market4. With a growth rate of 18.5%, Germany is showing significant momentum in cloud service adoption4.

[VERIFIED] Germany's SaaS market is expected to reach US$17.9 billion by 2025, growing at 18.5% year-over-year4.

Despite lagging behind in SaaS revenue model adoption compared to some European counterparts, Germany's strong economic foundation and increasing digitalization efforts across industries signal substantial growth potential for SaaS resellers4.

United Kingdom

The UK market demonstrates strong growth potential, with a 14.5% year-over-year expansion rate for SaaS and AI technologies2. As of late 2024, the UK's SaaS market size is estimated at US$23.81 billion, representing 8.5% of the global market2.

[VERIFIED] The UK's SaaS market is valued at US$23.81 billion, growing at 14.5% year-over-year2.

The UK government's proactive approach to technology adoption, particularly in AI, is expected to accelerate SaaS adoption across the enterprise software sector. This creates expanded opportunities for SaaS resellers who can align with national digital transformation priorities2.

Saudi Arabia

Saudi Arabia's SaaS market, while currently the smallest among the analyzed regions, shows promising long-term potential. With a market size of US$13.97 billion and representing 5% of the global market, Saudi Arabia is growing at a rate of 9.5% year-over-year58.

[VERIFIED] Saudi Arabia's SaaS market is valued at US$13.97 billion, with a 9.5% year-over-year growth rate58.

The Saudi market is characterized by evolving high-performance computing needs and increasing integration of artificial intelligence solutions8. While growth challenges persist, the emergence of multi-cloud strategies represents a significant opportunity for SaaS resellers with relevant expertise in navigating the unique aspects of the Saudi market.

An unexpected detail in our resereach was the low rate of SaaS adoption in the DACH region, with only 38% of software revenue coming from SaaS models, compared to approximately 75% in the Benelux countries and similar figures in the Nordics18.

This slower adoption rate is influenced by cultural purchasing preferences that traditionally favor on-premises solutions with greater perceived control and security. DACH enterprises typically conduct thorough due diligence processes before adopting new technologies, with particular emphasis on data security, compliance, and vendor stability. This creates opportunities for resellers who can demonstrate deep technical expertise and regulatory compliance but also limites reseller's scope of delivering SaaS solution.

Reseller Landscape Assessment

Understanding the existing reseller ecosystem across target regions provides critical context for expansion planning and competitive positioning. Our assessment reveals significant variations in reseller maturity, concentration, and value-addition approaches.

United States

The US SaaS reseller market is characterized by significant maturity and specialization, with value-added resellers (VARs) increasingly focusing on specific industry verticals or technology niches to differentiate their offerings.

The US reseller landscape features a blend of large, multi-vendor channel partners with national reach and specialized boutique resellers with deep expertise in specific industries or technologies. Geographic footprints typically cover major metropolitan areas with remote capabilities extending nationwide.

US resellers demonstrate high scalability potential through established operational frameworks, mature sales methodologies, and increasing use of automation technologies to improve efficiency. The market has seen consolidation through mergers and acquisitions, particularly in the mid-market segment, as resellers seek to expand capabilities and geographic coverage.

United Kingdom

The UK reseller landscape is well-developed but undergoing significant transformation as partners adapt to increased cloud adoption and changing vendor relationship models.

[ESTIMATED/INFERRED] UK-based VARs typically demonstrate strong technical capabilities combined with consulting expertise, positioning themselves as trusted advisors rather than transaction-focused resellers. Geographic coverage is concentrated in London and major regional business centers, with varying capabilities for nationwide service delivery.

The UK government's focus on AI adoption creates specific opportunities for resellers with relevant expertise, as outlined in the AI Opportunities Action Plan. This initiative emphasizes "laying the foundations to enable AI" through investments in computing infrastructure, talent development, and establishing frameworks for "safe and trusted AI development and adoption"6.

DACH Region

The DACH reseller landscape is characterized by technical depth and specialization, with a historical emphasis on on-premises solutions now gradually shifting toward cloud and hybrid models.

Research identifies 83 financial investors with current investments in 198 software companies across the DACH region, with specialized funds in the lower mid-market building substantial portfolios22. Approximately 22% of analyzed platforms generate annual revenues exceeding €50 million, with 10% surpassing the €100 million mark, indicating significant scalability potential22.

Geographic coverage within the DACH region tends to follow economic activity concentrations, with strongest presence in major German cities (Berlin, Munich, Frankfurt), followed by Zurich, Vienna, and other regional business centers.

United Arab Emirates

The UAE reseller market is less mature than Western counterparts but demonstrates rapid development and increasing sophistication in service offerings.

The UAE reseller landscape features a combination of global system integrators with regional operations, local technology providers expanding into SaaS, and specialized cloud service partners. Geographic focus is predominantly on Dubai and Abu Dhabi, with limited coverage in other emirates.

Scalability potential is significant given the market growth trajectory and increasing enterprise demand for cloud-based solutions. However, resellers face challenges related to talent acquisition and retention, which can constrain growth capabilities.

Saudi Arabia

Saudi Arabia's SaaS reseller ecosystem is the least developed among our target regions but shows promising growth indicators as digital transformation initiatives accelerate.

Companies in Saudi Arabia are striving to upgrade their infrastructures, adopt data-centric decision-making, and enhance operational efficiencies, driving increased demand for various cloud service models including SaaS8.

The reseller landscape includes a limited number of specialized cloud partners, traditional system integrators expanding into SaaS, and emerging local technology providers developing cloud capabilities. Geographic coverage is primarily concentrated in Riyadh, Jeddah, and the Eastern Province (Dammam/Khobar), with limited presence in secondary markets.

Scalability potential is constrained by regulatory considerations and talent availability but supported by strong growth in enterprise demand for cloud solutions. Successful resellers typically maintain close alignment with government initiatives and demonstrate strong local relationships.

Buyer Preferences Analysis

Understanding whether enterprises prefer purchasing through intermediaries (resellers) or directly from vendors provides critical insights for channel strategy development. Our analysis reveals significant variations in buyer preferences across target regions.

Click To Read Detailed Context and Chart Narrative

Value Added Reseller Participation by Region

Quantifying VAR participation and performance across regions provides essential context for expansion planning and channel strategy development. Our analysis examines participation rates and deal characteristics across target markets.

United States

The US market demonstrates sophisticated VAR participation with increasing specialization and value-added services beyond traditional reselling.

[ESTIMATED/INFERRED] Approximately 55% of enterprise SaaS deals in the US involve VARs, with average deal sizes ranging from $50,000 to $250,000 for mid-market implementations and reaching $1-5 million for enterprise-scale deployments.

VARs focusing on specific industry verticals (healthcare, financial services, manufacturing) typically command premium pricing and demonstrate higher customer retention rates compared to generalist resellers. The most successful VARs have evolved beyond transaction-focused models to provide ongoing managed services, integration expertise, and strategic consulting.

United Kingdom

The UK VAR landscape demonstrates strong participation rates with emphasis on compliance expertise and industry-specific knowledge.

[ESTIMATED/INFERRED] Approximately 57% of enterprise SaaS deals in the UK involve VARs, with average deal sizes ranging from £40,000 to £200,000 for mid-market implementations and reaching £750,000 to £3 million for enterprise-scale deployments.

Financial services represents the most active vertical for VAR participation, followed by public sector, manufacturing, and professional services. VARs with specialized AI expertise are positioned for growth given government priorities outlined in the AI Opportunities Action Plan.

DACH Region

The DACH region demonstrates the highest VAR participation rates among target markets, reflecting enterprise preferences for comprehensive service relationships.

[ESTIMATED/INFERRED] Approximately 68% of enterprise SaaS deals in the DACH region involve VARs, with average deal sizes ranging from €45,000 to €220,000 for mid-market implementations and reaching €800,000 to €4 million for enterprise-scale deployments.

Manufacturing represents the most active vertical for VAR participation, followed by automotive, financial services, and healthcare. VARs with multi-lingual capabilities (German, English, and French) demonstrate competitive advantages in serving regional enterprises.

United Arab Emirates

The UAE demonstrates growing VAR participation with emphasis on implementation services and localization capabilities.

[ESTIMATED/INFERRED] Approximately 62% of enterprise SaaS deals in the UAE involve VARs, with average deal sizes ranging from 180,000 to 800,000 AED for mid-market implementations and reaching 3-15 million AED for enterprise-scale deployments.

Government and semi-government organizations represent the most active vertical for VAR participation, followed by financial services, retail, and hospitality. VARs offering Arabic language support and localized implementation methodologies demonstrate competitive advantages.

Saudi Arabia

Saudi Arabia demonstrates the highest VAR participation rates among target markets, reflecting strong cultural preferences for relationship-based business transactions.

[ESTIMATED/INFERRED] Approximately 73% of enterprise SaaS deals in Saudi Arabia involve VARs, with average deal sizes ranging from 200,000 to 900,000 SAR for mid-market implementations and reaching 3.5-20 million SAR for enterprise-scale deployments.

Government entities represent the most active vertical for VAR participation, followed by oil and gas, financial services, and healthcare. VARs with local presence, appropriate certifications, and established relationships demonstrate significant competitive advantages.

Recommendations

Based on our comprehensive analysis of market growth, regulatory landscapes, reseller ecosystems, and buyer preferences, we recommend the following priority markets and strategic actions for SaaS resellers seeking expansion opportunities.

Priority Markets for Expansion

United States - The US market offers the largest immediate opportunity with 21.0% YoY growth and $221.46 billion market value by 2025321. The mature ecosystem, favorable regulatory environment, and sophisticated buyer behaviors create opportunities for specialized resellers with industry-specific expertise.

United Arab Emirates - With 18.5% YoY growth, the UAE represents an exceptional expansion opportunity, particularly for resellers who can address localization needs and establish strong local relationships. Government-led digital transformation initiatives create favorable conditions for cloud adoption.

Germany - Despite slower 18.5% YoY growth, the DACH region offers significant opportunities for specialized resellers who understand strict regulatory requirements and cultural purchasing preferences. The lower SaaS penetration (38%) indicates substantial room for growth but only if buyer preferences shift18.

United Kingdom - The UK market's 14.5% YoY growth, combined with government-led AI initiatives, creates strong opportunities for resellers with relevant expertise36. The balanced regulatory approach supports innovation while maintaining appropriate protections.

Saudi Arabia - While demonstrating the lowest current growth rate (9.5%), Saudi Arabia offers long-term potential with 15.50% CAGR through 2033 and strong preferences for reseller relationships38. The market requires significant investment in relationship building and local presence.

Strategic Actions

Develop vertical-specific expertise in target regions

Focus on industries with highest reseller participation rates in each region

Develop compliance expertise relevant to regulated industries

Build case studies and reference architectures demonstrating industry-specific value propositions

Address cultural "blind spots" in international expansion

Invest in AI capabilities aligned with regional priorities

Develop expertise in AI-powered SaaS solutions that address specific market needs

Align offerings with government initiatives, particularly in the UK and Saudi Arabia

Build capabilities to support the 70% of organizations transitioning to "small and wide data" approaches for AI systems9

Establish strategic partnerships with complementary providers

Partner with infrastructure providers to offer comprehensive solutions

Build relationships with systems integrators for complex implementations

Develop alliances with specialist consultancies in high-value verticals

Implement localization strategies tailored to each region

Develop region-specific marketing materials and sales methodologies

Address language requirements, particularly for UAE and Saudi Arabia

Adapt contracting approaches to align with regional preferences

By prioritizing these markets and implementing these strategic actions, SaaS resellers can position themselves for successful geographic expansion, leveraging the growth opportunities presented by increasing AI adoption and enterprise software demand across target regions.

Comments